Elastic net regression using coordinate descent in MQL5

Introduction

Elastic net regression combines the best qualities of the ridge and lasso techniques to build general linear models. Applying it makes it possible to minimize one of the main disadvantages of regression, overfitting. This is especially relevant to trading strategy development, as it is known, that the most common reason for poor performance or strategy failure.Comes as a result of mistaking noise for patterns during training. In this article we will present the implementation of elastic net regression, that uses the coordinate descent method of optimization in pure MQL5. Towards the end of the article we will demonstrate a practical application of this technique through the development of a simple moving average based predictive strategy.

Regularization

When building predictive models the goal is to create an exemplar that can discern some unique pattern that can be exploited for real world use. To do so effectively we have to ensure that the model is "learning" relevant patterns from the training data. This is obviously easier said than done. What usually happens is that the model ends up picking up on irrelevant information (noise) which ultimately hurts its performance when put to use. Regularization is a process used to minimize the effects of overfitting.

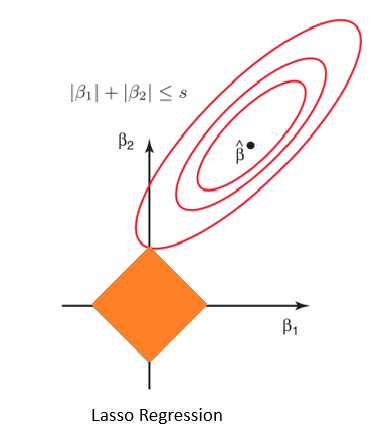

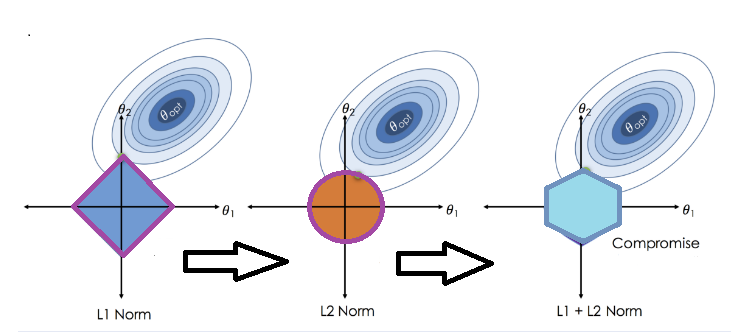

The lasso technique helps reduce training bias by repressing redundant predictors when the model is defined by too many optimizable variables. Thereby simplifying the model.

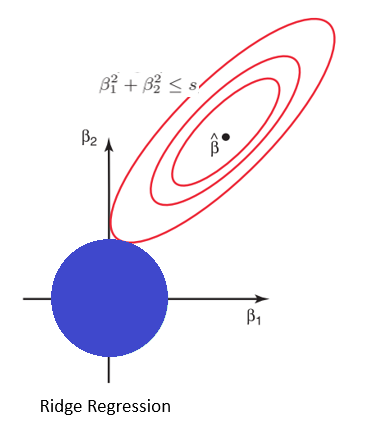

In ridge regression, coefficients of the regression equation are minimized so as to move them away from their optimum. This helps to generalize the model whilst still keeping all the predictors.

Both the lasso and the ridge are distinguished by the nature of the penalty term applied. The elastic net regression penalty term is a combination of the absolute value and square of the coefficents, weighted by two hyperparameters, alpha and lambda.

This way, alpha controls the type of regularization. When alpha is zero the penalty term reduces to the l2-norm, alternatively, when alpha is 1 the penalty function becomes the l1-norm. Specification of alpha that is between 0 and 1 makes it possible to build linear models that combine the qualities of both ridge and lasso regression to a certain degree as governed by the lambda hyperparameter which controls the degree of regularization.

Such models can be a boon when applied to trading strategy development where we often find ourselves blindly applying numerous predictors in the hope of finding some combination that produces profit. Using elastic net regression we can minimize overfitting whilst also being able to separate useless indicators from those that have significant predictive potential. And we can do this without worrying about how the indicators are related to each other. It almost seems too good to be true.

Coordinate Descent

Coordinate descent is a method of optimization well suited to multivariable optimization. A complex multidimensional optimization problem is reduced into a collection of one dimensional problems. Achieved by iteratively minimizing each of the individual dimensions of a function , whilst keeping the values of the function in other dimensions static. There are numerous resources on the internet that can provide more detailed explanations for those interested. Here, we are interested in its application to strategy development.

For our purposes, the coordinate descent method will be used in two ways in the implementation of elastic net regression. First it will be used to determine the optimal lambda based on a fixed alpha, specified by the user. Once this is done, the optimization method is called again to work on the beta coefficients of the regression equation. Lets dive into some code to see how this is accomplished.

The CCoordinateDescent class

//+------------------------------------------------------------------+ //| Coordinate Descent optimization class | //+------------------------------------------------------------------+ class CCoordinateDescent { private: bool m_initialized; // Was everything legal and allocs successful? double m_beta[]; // Beta coefs (m_nvars of them) double m_explained; // Fraction of variance m_explained by model; computed by Train() double m_xmeans[]; // Mean of each X predictor double m_xscales[]; // And standard deviation double m_ymean; // Intercept (mean of Y) double m_yscale; // Standard deviation of Y int m_nvars ; // Number of variables int m_observs ; // Number of cases bool m_covarupdates ; // Does user want (often faster) covariance update method? int m_nlambda ; // Reserve space for this many m_beta sets for saving by TrainLambda() (may be zero) double m_lambdabeta_matrix[]; // Saved m_beta coefs (m_nlambda sets of m_nvars of them) double m_lambdas[]; // Lambdas tested by TrainLambda() double m_x_matrix[]; // Normalized (mean=0, std=1) X; m_observs by m_nvars double m_y[]; // Normalized (mean=0, std=1) Y double m_resid[]; // Residual double m_xinner_matrix[]; // Nvars square inner product matrix if m_covarupdates double m_yinner[]; // Nvars XY inner product vector if m_covarupdates public: //constructor CCoordinateDescent(const int num_predictors, const int num_observations, const bool use_covariance_updates, const int num_lambdas_to_trial) ; //desctructor ~CCoordinateDescent(void) ; //Accessor methods for private properties double GetYmean(void) { return m_ymean; } double GetYscale(void) { return m_yscale;} double GetExplainedVariance(void) { return m_explained;} double GetXmeansAt(const int index) { if(index>=0 && index<ArraySize(m_xmeans)) return m_xmeans[index]; else return 0;} double GetXscalesAt(const int index) { if(index>=0 && index<ArraySize(m_xscales)) return m_xscales[index]; else return 0;} double GetBetaAt(const int index) { if(index>=0 && index<ArraySize(m_beta)) return m_beta[index]; else return 0;} double GetLambdaAt(const int index) { if(index>=0 && index<ArraySize(m_lambdas)) return m_lambdas[index]; else return 0;} double GetLambdaBetaAt(const int index) { if(index>=0 && index<ArraySize(m_lambdabeta_matrix)) return m_lambdabeta_matrix[index]; else return 0;} double GetLambdaThreshold(const double alpha) ; //Set model parameters and raw input data bool SetData(const int begin, const int num_observations, double &xx_matrix[], double &yy[]) ; //Training routines void Train(const double alpha, const double lambda, const int maxits, const double convergence_criterion, const bool fast_test, const bool warm_start) ; void TrainLambda(const double alpha, const int maxits, const double convergence_criterion, const bool fast_test, const double maxlambda, const bool print_steps) ; } ;

The CCoordinateDescent class is defined in the CoordinateDescent.mqh file. Its constructor is parametric and is used to specify important features of a model, but before we get into this, there are some pertinent issues about a specific data construct to be used.

The library we will specify will not use any unique data types, such as the new matrix and vector types of MQL5. This is to ensure compatibility with mql4. Since there is no way to dynamically define multidimensional arrays, matrices will be represented as regular flat arrays. An example is the best way to illustrate the construct.

Supose we want to define a matrix with 4 rows and 3 columns. We would create an array of size 4 multiplied by 3 , ie 12. The members of this array will be arranged as they would appear if using the built in matrix data type. That is to say, using our example, the first row members are specified first, then the second row members, and so on. The code snippet below illustrates the creation of a 4 by 3 matrix , where the each value in a column is the same.

int rows=4, columns=3; double our_matrix[]; ArrayResize(our_matrix,rows*columns); /* Creating matrix with columns of 1s,2s,3s */ for(int i = 0; i<rows; i++) for(int j=0; j<columns; j++) our_matrix[i*columns+j]=j+1; ArrayPrint(our_matrix);

Output from ArrayPrint.

KP 0 13:01:32.445 Construct(GBPUSD,D1) 1.00000 2.00000 3.00000 1.00000 2.00000 3.00000 1.00000 2.00000 3.00000 1.00000 2.00000 3.00000

When traversing the array in matrix fashion, we have the row index * the number of columns + the column index. Instances where such array constructs are required are all denoted by the _matrix suffix to either a class variable name or a function parameter name.

Using this construct means that when matices are passed to functions, a few function parameters have to be reserved for the specification of the dimensions of a particular matrix. I am sure it will become a lot more intuitive once we get to the application of the class towards the end of the article. Users are free to fork the library if not interested in cross platform portability. Back to the description of the class.

//+------------------------------------------------------------------+ //|Constructor | //+------------------------------------------------------------------+ CCoordinateDescent::CCoordinateDescent( const int num_predictors, // Number of predictor variables const int num_observations, // Number of cases we will be training const bool use_covariance_updates, // Use fast covariance updates rather than slow naive method const int num_lambdas_to_trial // Number of m_lambdas we will be using in training )

The parametric constructor requires 4 parameters:

- num_predictors sets the number of variables, this is the number of predictors or indicators, each set of indicators will occupy a column in the internal data matrix.

- num_observations specifies the amount of data the object should expect, this would be the number of rows or the exact number elements available in each set of variables/predictors/indicators.

- use_covariance_updates is a boolean option that should ideally be used when there are more more num_observations than num_predictors.Setting it to true provides significant improvements in excecution time relative to the alternative. This option should be considered only when num_observations > num_predictors.

- num_lambdas_to_trial sets the maximum number of lambda variations that will be tested during the training process.

The constructor simply prepares the internal data structures to receive all the required data.

{

m_nvars = num_predictors ;

m_observs = num_observations ;

m_covarupdates = use_covariance_updates ;

m_nlambda = num_lambdas_to_trial ;

m_initialized=true;

m_ymean=m_yscale=m_explained=0;

if(m_nvars<0 || m_observs<0 || m_nlambda<0)

{

m_initialized=false;

Print("Invalid parameter value, neither num_predictors ,num_observations, nor num_lambdas_to_trial can be negative");

return;

}

if(ArrayResize(m_x_matrix,m_observs*m_nvars)<m_observs*m_nvars ||

ArrayResize(m_y,m_observs)<m_observs ||

ArrayResize(m_xmeans,m_nvars)<m_nvars ||

ArrayResize(m_xscales,m_nvars)<m_nvars ||

ArrayResize(m_beta,m_nvars)<m_nvars ||

ArrayResize(m_resid,m_observs)<m_observs)

m_initialized=false;

//---conditional allocation

if(m_covarupdates)

{

if(ArrayResize(m_xinner_matrix,m_nvars*m_nvars)<m_nvars*m_nvars||

ArrayResize(m_yinner,m_nvars)<m_nvars)

m_initialized=false;

}

//---

if(m_nlambda>0)

{

if(ArrayResize(m_lambdabeta_matrix,m_nlambda*m_nvars)<m_nlambda*m_nvars ||

ArrayResize(m_lambdas,m_nlambda)<m_nlambda)

m_initialized=false;

}

//---return immediately if any error

if(!m_initialized)

Print("Memory allocation error ", GetLastError());

}

Once an instance of CCoordinateDescent is created, we then have to collect all the predictors and target values for preprocessing. This is done by the SetData method. Its first parameter is a starting index showing where in the arrays, to be supplied to this method, to begin collecting data. Doing it this way helps when conducting cross validation later on.

//+------------------------------------------------------------------+ //|Get and standardize the data | //| Also compute inner products if covar_update | //+------------------------------------------------------------------+ bool CCoordinateDescent::SetData( const int begin, // Starting index in full database for getting m_observs of training set const int num_observations,// Number of cases in full database (we wrap back to the start if needed) double &xx_matrix[], // Full database (num_observations rows, m_nvars columns) double &yy[] // Predicted variable vector, num_observations long )

num_observations is parameter name already encountered in the constructor, here it is used a little differently. If a lesser value is set here than the one used at object instantiation, then it enables the ability to revert back to the first value in the array once this index position is reached. If such functionality is not required then set this to the same value used in the constructor call. Just donot set it to zero or below. As this will induce an error.

The next required parameter xx_matrix is an array with the special matrix arrangement discussed. This where we input the raw indicators. It should be of the size specified in the constructor call, ie num_observations * num_predictors.

The last parameter yy is an array of corresponding target values.

The method standardizes both input arrays before copying these to the internal object buffers.

{

if(!m_initialized)

return false;

// parameter checks

if(begin<0 || num_observations<0)

{

Print("Invalid parameter value: neither begin nor num_observations can be negative");

return false;

}

//--- invalid a

if(ArraySize(xx_matrix)<(m_observs*m_nvars) || ArraySize(yy)<m_observs)

{

Print("Insufficient data supplied relative to object specification");

return false;

}

//---

int icase, ivar, jvar, k,xptr;

double sum, xm, xs, diff;

/*

Standardize X

*/

for(ivar=0 ; ivar<m_nvars ; ivar++)

{

xm = 0.0 ;

for(icase=0 ; icase<m_observs ; icase++)

{

k = (icase + begin) % num_observations ;

xm += xx_matrix[k*m_nvars+ivar] ;

}

xm /= m_observs ;

m_xmeans[ivar] = xm ;

xs = 1.e-60 ; // Prevent division by zero later

for(icase=0 ; icase<m_observs ; icase++)

{

k = (icase + begin) % num_observations ;

diff = xx_matrix[k*m_nvars+ivar] - xm ;

xs += diff * diff ;

}

xs = sqrt(xs / m_observs) ;

m_xscales[ivar] = xs ;

for(icase=0 ; icase<m_observs ; icase++)

{

k = (icase + begin) % num_observations ;

m_x_matrix[icase*m_nvars+ivar] = (xx_matrix[k*m_nvars+ivar] - xm) / xs ;

}

}

/*

Standardize Y

*/

m_ymean = 0.0 ;

for(icase=0 ; icase<m_observs ; icase++)

{

k = (icase + begin) % num_observations ;

m_ymean += yy[k] ;

}

m_ymean /= m_observs ;

m_yscale = 1.e-60 ; // Prevent division by zero later

for(icase=0 ; icase<m_observs ; icase++)

{

k = (icase + begin) % num_observations ;

diff = yy[k] - m_ymean ;

m_yscale += diff * diff ;

}

m_yscale = sqrt(m_yscale / m_observs) ;

for(icase=0 ; icase<m_observs ; icase++)

{

k = (icase + begin) % num_observations ;

m_y[icase] = (yy[k] - m_ymean) / m_yscale ;

}

/*

If user requests covariance updates, compute required inner products

We store the full m_xinner_matrix matrix for faster addressing later,

even though it is symmetric.

We handle both unweighted and weighted cases here.

*/

if(m_covarupdates)

{

for(ivar=0 ; ivar<m_nvars ; ivar++)

{

xptr = ivar ;

// Do XiY

sum = 0.0 ;

for(icase=0 ; icase<m_observs ; icase++)

sum += m_x_matrix[xptr+icase*m_nvars] * m_y[icase] ;

m_yinner[ivar] = sum / m_observs ;

// Do XiXj

for(jvar=0 ; jvar<m_nvars ; jvar++)

{

if(jvar == ivar)

m_xinner_matrix[ivar*m_nvars+jvar] = 1.0 ; // Recall that X is standardized

else

if(jvar < ivar) // Matrix is symmetric, so just copy

m_xinner_matrix[ivar*m_nvars+jvar] = m_xinner_matrix[jvar*m_nvars+ivar] ;

else

{

sum = 0.0 ;

for(icase=0 ; icase<m_observs ; icase++)

sum += m_x_matrix[xptr+icase*m_nvars] * m_x_matrix[icase*m_nvars+jvar] ;

m_xinner_matrix[ivar*m_nvars+jvar] = sum / m_observs ;

}

}

} // For ivar

}

//---

return true;

} If SetData completes successfully by returning true, a user is free to call either Train() or TrainLambda() depending on what they want to do.

//+------------------------------------------------------------------+ //|Core training routine | //+------------------------------------------------------------------+ void CCoordinateDescent::Train( const double alpha, // User-specified alpha, (0,1) (0 problematic for descending lambda) const double lambda, // Can be user-specified, but usually from TrainLambda() const int maxits, // Maximum iterations, for safety only const double convergence_criterion, // Convergence criterion, typically 1.e-5 or so const bool fast_test, // Base convergence on max m_beta change vs m_explained variance? const bool warm_start // Start from existing m_beta, rather than zero? )

The Train() method is where core optimization is done. Its here where the type of regularization (alpha) and the degree of regularization (lambda) are specified. Along with the type ofconvergence test to be conducted (fast_test) and the required accuracy for convergence to be attained (convergence_criterion).

- The maxits parameter is a fail safe that prevents the routine from taking an unresonable amount of time to complete, it should be set to a reasonably large value, like 1000 or more.

- warm_start indicates whether to begin training with beta weights initialized to zero or otherwise.

{

if(!m_initialized)

return;

if(alpha<0 || alpha>1)

{

Print("Invalid parameter value: Legal values for alpha are between 0 and 1 inclusive");

return;

}

if(lambda<0)

{

Print("Invalid parameter value: lambda accepts only positive values");

return;

}

if(maxits<=0)

{

Print("Invalid parameter value: maxist accepts only non zero positive values");

return;

}

int i, iter, icase, ivar, kvar, do_active_only, active_set_changed, converged,xptr ;

double residual_sum, S_threshold, argument, new_beta, correction, update_factor ;

double sum, explained_variance, crit, prior_crit, penalty, max_change, Xss, YmeanSquare ;

/*

Initialize

*/

S_threshold = alpha * lambda ; // Threshold for the soft-thresholding operator S()

do_active_only = 0 ; // Begin with a complete pass

prior_crit = 1.0e60 ; // For convergence test

if(warm_start) // Pick up with current betas?

{

if(! m_covarupdates) // If not using covariance updates, must recompute residuals

{

for(icase=0 ; icase<m_observs ; icase++)

{

xptr = icase * m_nvars ;

sum = 0.0 ;

for(ivar=0 ; ivar<m_nvars ; ivar++)

sum += m_beta[ivar] * m_x_matrix[xptr+ivar] ;

m_resid[icase] = m_y[icase] - sum ;

}

}

}

else // Not warm start, so initial betas are all zero

{

for(i=0 ; i<m_nvars ; i++)

m_beta[i] = 0.0 ;

for(i=0 ; i<m_observs ; i++) // Initial residuals are just the Y variable

m_resid[i] = m_y[i] ;

}

// YmeanSquare will remain fixed throughout training.

// Its only use is for computing m_explained variance for the user's edification.

YmeanSquare = 1.0 ;

/*

Outmost loop iterates until converged or user's maxits limit hit

*/

for(iter=0 ; iter<maxits ; iter++)

{

/*

Pass through variables

*/

active_set_changed = 0 ; // Did any betas go to/from 0.0?

max_change = 0.0 ; // For fast convergence test

for(ivar=0 ; ivar<m_nvars ; ivar++) // Descend on this m_beta

{

if(do_active_only && m_beta[ivar] == 0.0)

continue ;

Xss = 1 ; // X was standardized

update_factor = Xss + lambda * (1.0 - alpha) ;

if(m_covarupdates) // Any sensible user will specify this unless m_observs < m_nvars

{

sum = 0.0 ;

for(kvar=0 ; kvar<m_nvars ; kvar++)

sum += m_xinner_matrix[ivar*m_nvars+kvar] * m_beta[kvar] ;

residual_sum = m_yinner[ivar] - sum ;

argument = residual_sum + Xss * m_beta[ivar] ; // Argument to S() [MY FORMULA]

}

else

// Use slow definitional formula (okay if m_observs < m_nvars)

{

residual_sum = 0.0 ;

xptr = ivar ; // Point to column of this variable

for(icase=0 ; icase<m_observs ; icase++)

residual_sum += m_x_matrix[xptr+icase*m_nvars] * m_resid[icase] ; // X_ij * RESID_i

residual_sum /= m_observs ;

argument = residual_sum + m_beta[ivar] ; // Argument to S() ; (Eq 8)

}

// Apply the soft-thresholding operator S()

if(argument > 0.0 && S_threshold < argument)

new_beta = (argument - S_threshold) / update_factor ;

else

if(argument < 0.0 && S_threshold < -argument)

new_beta = (argument + S_threshold) / update_factor ;

else

new_beta = 0.0 ;

// Apply the update, if changed, and adjust the residual if using naive or weighted updates

// This is also used to update the fast convergence criterion

correction = new_beta - m_beta[ivar] ; // Will use this to adjust residual if using naive updates

if(fabs(correction) > max_change)

max_change = fabs(correction) ; // Used for fast convergence criterion

if(correction != 0.0) // Did this m_beta change?

{

if(! m_covarupdates) // Must we update the residual vector (needed for naive methods)?

{

xptr = ivar ; // Point to column of this variable

for(icase=0 ; icase<m_observs ; icase++) // Update residual for this new m_beta

m_resid[icase] -= correction * m_x_matrix[xptr+icase*m_nvars] ;

}

if((m_beta[ivar] == 0.0 && new_beta != 0.0) || (m_beta[ivar] != 0.0 && new_beta == 0.0))

active_set_changed = 1 ;

m_beta[ivar] = new_beta ;

}

} // For all variables; a complete pass

/*

A pass (complete or active only) through variables has been done.

If we are using the fast convergence test, it is simple. But if using the slow method...

Compute m_explained variance and criterion; compare to prior for convergence test

If the user requested the covariance update method, we must compute residuals for these.

*/

if(fast_test) // Quick and simple test

{

if(max_change < convergence_criterion)

converged = 1 ;

else

converged = 0 ;

}

else // Slow test (change in m_explained variance) which requires residual

{

if(m_covarupdates) // We have until now avoided computing residuals

{

for(icase=0 ; icase<m_observs ; icase++)

{

xptr = icase * m_nvars ;

sum = 0.0 ;

for(ivar=0 ; ivar<m_nvars ; ivar++)

sum += m_beta[ivar] * m_x_matrix[xptr+ivar] ; // Cumulate predicted value

m_resid[icase] = m_y[icase] - sum ; // Residual = true - predicted

}

}

sum = 0.0 ; // Will cumulate squared error for convergence test

for(i=0 ; i<m_observs ; i++)

sum += m_resid[i] * m_resid[i] ;

crit = sum / m_observs ; // MSE component of optimization criterion

explained_variance = (YmeanSquare - crit) / YmeanSquare ; // Fraction of Y m_explained

penalty = 0.0 ;

for(i=0 ; i<m_nvars ; i++)

penalty += 0.5 * (1.0 - alpha) * m_beta[i] * m_beta[i] + alpha * fabs(m_beta[i]) ;

penalty *= 2.0 * lambda ; // Regularization component of optimization criterion

crit += penalty ; // This is what we are minimizing

if(prior_crit - crit < convergence_criterion)

converged = 1 ;

else

converged = 0 ;

prior_crit = crit ;

}

/*

After doing a complete (all variables) pass, we iterate on only

the active set (m_beta != 0) until convergence. Then we do a complete pass.

If the active set does not change, we are done:

If a m_beta goes from zero to nonzero, by definition the active set changed.

If a m_beta goes from nonzero to another nonzero, then this is a theoretical flaw

in this process. However, if we just iterated the active set to convergence,

it is highly unlikely that we would get anything other than a tiny move.

*/

if(do_active_only) // Are we iterating on the active set only?

{

if(converged) // If we converged

do_active_only = 0 ; // We now do a complete pass

}

else // We just did a complete pass (all variables)

{

if(converged && ! active_set_changed)

break ;

do_active_only = 1 ; // We now do an active-only pass

}

} // Outer loop iterations

/*

We are done. Compute and save the m_explained variance.

If we did the fast convergence test and covariance updates,

we must compute the residual in order to get the m_explained variance.

Those two options do not require regular residual computation,

so we don't currently have the residual.

*/

if(fast_test && m_covarupdates) // Residuals have not been maintained?

{

for(icase=0 ; icase<m_observs ; icase++)

{

xptr = icase * m_nvars ;

sum = 0.0 ;

for(ivar=0 ; ivar<m_nvars ; ivar++)

sum += m_beta[ivar] * m_x_matrix[xptr+ivar] ;

m_resid[icase] = m_y[icase] - sum ;

}

}

sum = 0.0 ;

for(i=0 ; i<m_observs ; i++)

sum += m_resid[i] * m_resid[i] ;

crit = sum / m_observs ; // MSE component of optimization criterion

m_explained = (YmeanSquare - crit) / YmeanSquare ; // This variable is a member of the class

} As we iterate through observations we also calculate the fraction of explained target variance. When the slow convergence test is used (fast_test set to false), convergence is attained when the change from one iteration to the next is less than the specified convergence criterion value.

Other wise if the fast method is used convergence is achieved when the maximum change in beta adjustment amongst all betas is less than the convergence criterion.

//+------------------------------------------------------------------+ //|Compute minimum lambda such that all betas remain at zero | //+------------------------------------------------------------------+ double CCoordinateDescent::GetLambdaThreshold(const double alpha) { if(!m_initialized) return 0; if(alpha>1 || alpha<0) { Print("Invalid parameter for Alpha, legal values are between 0 and 1 inclusive"); return 0; } int ivar, icase,xptr ; double thresh, sum; thresh = 0.0 ; for(ivar=0 ; ivar<m_nvars ; ivar++) { xptr = ivar ; sum = 0.0 ; for(icase=0 ; icase<m_observs ; icase++) sum += m_x_matrix[xptr+icase*m_nvars] * m_y[icase] ; sum /= m_observs ; sum = fabs(sum) ; if(sum > thresh) thresh = sum ; } return thresh / (alpha + 1.e-60) ; }

GetLambdaThreshold() requires a single input parameter specifying the type of regularization. This method returns the calculated value of lambda for which all corresponding betas are zero. The idea is that, such a value would be a good place to begin searching for the optimal lambda hyperparameter for a given alpha.

The actual optimization of lambda is done by TrainLambda(). It has similar function parameters to Train(). A user can specify the starting lambda value through maxlambda. Setting it to 0 or less automatically engages GetlambdaThreshold() to set the true starting value. The main loop repeatedly calls Train() and saves the betas for each lambda, for a maximum of m_nlambda iterations specified in the constructor call.

//+----------------------------------------------------------------------------------------+ //| Multiple-lambda training routine calls Train() repeatedly, saving each m_beta vector | | //+----------------------------------------------------------------------------------------+ void CCoordinateDescent::TrainLambda( const double alpha, // User-specified alpha, (0,1) (0 problematic for descending lambda) const int maxits, // Maximum iterations, for safety only const double convergence_criterion, // Convergence criterion, typically 1.e-5 or so const bool fast_test, // Base convergence on max m_beta change vs m_explained variance? const double maxlambda, // Starting lambda, or negative for automatic computation const bool print_steps // Print lambda/m_explained table? ) { if(!m_initialized) return; int ivar, ilambda, n_active ; double lambda, min_lambda, lambda_factor,max_lambda=maxlambda; string fprint ; if(m_nlambda <= 1) return ; /* Compute the minimum lambda for which all m_beta weights remain at zero This (slightly decreased) will be the lambda from which we start our descent. */ if(max_lambda <= 0.0) max_lambda = 0.999 * GetLambdaThreshold(alpha) ; min_lambda = 0.001 * max_lambda ; lambda_factor = exp(log(min_lambda / max_lambda) / (m_nlambda-1)) ; /* Repeatedly train with decreasing m_lambdas */ if(print_steps) { fprint+="\nDescending lambda path..."; } lambda = max_lambda ; for(ilambda=0 ; ilambda<m_nlambda ; ilambda++) { m_lambdas[ilambda] = lambda ; // Save in case we want to use later Train(alpha, lambda, maxits, convergence_criterion, fast_test,(bool)ilambda) ; for(ivar=0 ; ivar<m_nvars ; ivar++) m_lambdabeta_matrix[ilambda*m_nvars+ivar] = m_beta[ivar] ; if(print_steps) { n_active = 0 ; for(ivar=0 ; ivar<m_nvars ; ivar++) { if(fabs(m_beta[ivar]) > 0.0) ++n_active ; } fprint+=StringFormat("\n %8.4lf %4d %12.4lf", lambda, n_active, m_explained) ; } lambda *= lambda_factor ; } if(print_steps) Print(fprint); }

Our coordinate descent class is complete. What we require next is a tool to conduct cross validation with, in order to tune the lambda hyperparameter.

OptimizeLambda function

//+------------------------------------------------------------------------------------------+ //| Cross-validation training routine calls TrainLambda() repeatedly to optimize lambda | //+------------------------------------------------------------------------------------------+ double OptimizeLambda( int n_observations, // Number of cases in full database int n_predictors, // Number of variables (columns in database) int n_folds, // Number of folds bool covar_updates, // Does user want (usually faster) covariance update method? int n_lambda, // This many out_lambdas tested by lambda_train() (must be at least 2) double alpha, // User-specified alpha, (0,1) (0 problematic for descending lambda) int maxits, // Maximum iterations, for safety only double convergence_criterion, // Convergence criterion, typically 1.e-5 or so bool fast_test, // Base convergence on max beta change vs explained variance? double &in_matrix[], // Full database (n_observations rows, n_predictors columns) double &in_targets[], // Predicted variable vector, n_observations long double &out_lambdas[], // Returns out_lambdas tested by lambda_train() double &out_lambda_OOS[], // Returns OOS explained for each of above out_lambdas bool print_output = false // show full output )

Its main purpose is to implement cross validation training to automatically select the lambda hyperparameter. Most of its input parameters have familiar names, because the routine uses coordinate descent optimization.

This function can be optionaly used when a user is not sure what value of lambda to use. Cross validation is the go to technique for tuning hyperparameters. To use it we would obviously pass the same training data, that will eventually be used to build the complete regression model.

in_matrix is the input for the matrix of predictors, in_targets is for the corresponding targets. In addition to these input arrays we also have to supply two more arrays. out_lambdas and out_lambda_OOS are arrays that will hold the finer details of the cross validation process.

The last parameter indicates whether to print the results of the process to the terminal.

{

int i_IS, n_IS, i_OOS, n_OOS, n_done, ifold ;

int icase, ivar, ilambda, ibest, k,coefs ;

double pred, sum, diff, max_lambda, Ynormalized, YsumSquares, best,work[] ;

CCoordinateDescent *cd ;

if(n_lambda < 2)

return 0.0 ;

/*

Use the entire dataset to find the max lambda that will be used for all descents.

Also, copy the normalized case weights if there are any.

*/

cd = new CCoordinateDescent(n_predictors, n_observations, covar_updates, n_lambda) ;

cd.SetData(0, n_observations, in_matrix, in_targets) ; // Fetch the training set for this fold

max_lambda = cd.GetLambdaThreshold(alpha) ;

delete cd ;

if(print_output)

PrintFormat("%s starting for %d folds with max lambda=%.9lf",__FUNCTION__, n_folds, max_lambda) ;

i_IS = 0 ; // Training data starts at this index in complete database

n_done = 0 ; // Number of cases treated as OOS so far

for(ilambda=0 ; ilambda<n_lambda ; ilambda++)

out_lambda_OOS[ilambda] = 0.0 ; // Will cumulate across folds here

YsumSquares = 0.0 ; // Will cumulate to compute explained fraction

/*

Process the folds

*/

for(ifold=0 ; ifold<n_folds ; ifold++)

{

n_OOS = (n_observations - n_done) / (n_folds - ifold) ; // Number OOS (test set)

n_IS = n_observations - n_OOS ; // Number IS (training set)

i_OOS = (i_IS + n_IS) % n_observations ; // OOS starts at this index

// Train the model with this IS set

cd = new CCoordinateDescent(n_predictors, n_IS, covar_updates, n_lambda) ;

cd.SetData(i_IS, n_observations, in_matrix, in_targets) ; // Fetch the training set for this fold

cd.TrainLambda(alpha, maxits, convergence_criterion, fast_test, max_lambda,print_output) ; // Compute the complete set of betas (all out_lambdas)

// Compute OOS performance for each lambda and sum across folds.

// Normalization of X and Y is repeated, when it could be done once and saved.

// But the relative cost is minimal, and it is simpler doing it this way.

for(ilambda=0 ; ilambda<n_lambda ; ilambda++)

{

out_lambdas[ilambda] = cd.GetLambdaAt(ilambda) ; // This will be the same for all folds

coefs = ilambda * n_predictors ;

sum = 0.0 ;

for(icase=0 ; icase<n_OOS ; icase++)

{

k = (icase + i_OOS) % n_observations ;

pred = 0.0 ;

for(ivar=0 ; ivar<n_predictors ; ivar++)

pred += cd.GetLambdaBetaAt(coefs+ivar) * (in_matrix[k*n_predictors+ivar] - cd.GetXmeansAt(ivar)) / cd.GetXscalesAt(ivar) ;

Ynormalized = (in_targets[k] - cd.GetYmean()) / cd.GetYscale() ;

diff = Ynormalized - pred ;

if(ilambda == 0)

YsumSquares += Ynormalized * Ynormalized ;

sum += diff * diff ;

}

out_lambda_OOS[ilambda] += sum ; // Cumulate for this fold

} // For ilambda

delete cd ;

n_done += n_OOS ; // Cumulate OOS cases just processed

i_IS = (i_IS + n_OOS) % n_observations ; // Next IS starts at this index

} // For ifold

/*

Compute OOS explained variance for each lambda, and keep track of the best

*/

best = -1.e60 ;

for(ilambda=0 ; ilambda<n_lambda ; ilambda++)

{

out_lambda_OOS[ilambda] = (YsumSquares - out_lambda_OOS[ilambda]) / YsumSquares ;

if(out_lambda_OOS[ilambda] > best)

{

best = out_lambda_OOS[ilambda] ;

ibest = ilambda ;

}

}

if(print_output)

PrintFormat("\n%s ending with best lambda=%9.9lf explained=%9.9lf",__FUNCTION__, out_lambdas[ibest], best) ;

return out_lambdas[ibest] ;

}

//+------------------------------------------------------------------+

The function uses a local instance of CCoordinateDescent to test a set of lambdas. The number of tested lambdas is set by the n_lambda parameter of the function. Tested lambdas begin from the maximum calculated by calling GetLambdaThreshold(). After each testing iteration the previous lambda value is decreased slightly.Each lambda test generates new beta coefficients that are used to calculate the fraction of explained variance. All this is done for each fold. The results from all folds are examined and the best is selected. The lambda that gave the best result is returned as the optimal lambda.

With all the code utilities described, its time to put them to work.

An Example

To demonstrate the practical application of this method, we will use it to build a model that predicts the price change to the next bar based on a bunch of long and short moving averages. We want to find the set of moving averages that are most useful for predicting the next bar's price change.

To implement this we supply the model with indicators calculated based on log transformed raw prices, with the targets being the log differences. We need an indicator that log tranforms raw prices, so that other indicators (in this case being the moving average) can reference it. The log prices indicator is shown below.

//+------------------------------------------------------------------+ //| LogPrices.mq5 | //| Copyright 2023, MetaQuotes Software Corp. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2023, MetaQuotes Software Corp." #property link "https://www.mql5.com" #property version "1.00" #property indicator_separate_window #property indicator_buffers 1 #property indicator_plots 1 //--- plot Log #property indicator_label1 "Log" #property indicator_type1 DRAW_LINE #property indicator_color1 clrTurquoise #property indicator_style1 STYLE_SOLID #property indicator_width1 1 //--- indicator buffers double LogBuffer[]; //+------------------------------------------------------------------+ //| Custom indicator initialization function | //+------------------------------------------------------------------+ int OnInit() { //--- indicator buffers mapping SetIndexBuffer(0,LogBuffer,INDICATOR_DATA); //--- return(INIT_SUCCEEDED); } //+------------------------------------------------------------------+ //| Custom indicator iteration function | //+------------------------------------------------------------------+ int OnCalculate(const int rates_total, const int prev_calculated, const int begin, const double &price[]) { //--- for(int i=(prev_calculated>0)?prev_calculated-1:0; i<rates_total; i++) LogBuffer[i]=(price[i]>0)?log(price[i]):0; //--- return value of prev_calculated for next call return(rates_total); } //+------------------------------------------------------------------+

The training program will be implemented as a script. We begin by specifying the essential include files and the script's inputs. The inputs allow a user to adjust various aspects of the program to suit their needs. This includes the ability to set the dates for the training and testing time spans.

//+------------------------------------------------------------------+ //| ElasticNetRegressionModel_MA.mq5 | //| Copyright 2023, MetaQuotes Software Corp. | //| https://www.mql5.com | //+------------------------------------------------------------------+ #property copyright "Copyright 2023, MetaQuotes Software Corp." #property link "https://www.mql5.com" #property version "1.00" #resource "\\Indicators\\LogPrices.ex5" #include<CoordinateDescent.mqh> #include<ErrorDescription.mqh> #property script_show_inputs //--- input parameters input uint MA_period_inc=2; //MA lookback increment input uint Num_MA_periods=30; //Num of lookbacks input double Alpha=0.5; input int AppliedPrice=PRICE_CLOSE; input ENUM_MA_METHOD MaMethod=MODE_EMA; input ENUM_TIMEFRAMES tf=PERIOD_D1; //time frame input uint BarsLookAhead=1; input uint Num_Folds = 10; //Num of Folds for cross validation input uint MaximumIterations=1000; input datetime TrainingSampleStartDate=D'2019.12.31'; input datetime TrainingSampleStopDate=D'2022.12.31'; input datetime TestingSampleStartDate=D'2023.01.02'; input datetime TestingSampleStopDate=D'2023.06.30'; input string SetSymbol=""; input bool UseCovarUpdates=true; input bool UseFastTest=true; input bool UseWarmStart=false; input int NumLambdasToTest=50; input bool ShowFullOutPut=false; //print full output to terminal

Important user input options are the MA_period_inc input which sets the period increments. Num_Ma_periods defines the number of moving averages that will be supplied to the algorithm. The indicator values to be used as predictors will be the difference between a long and short moving average. The short moving average is calculated as being half of the period of the resulting long moving average. The long moving average is determined by incrementing by MA_period_inc , Num_MA_period times.

Num_Folds stipulates the number of folds to be used by the Optimizelambda function during cross validation.

Other inputs are self explanatory.

The script begins by enumerating the training and testing data sets. Local buffers are resized based on the chosen user inputs.

//+------------------------------------------------------------------+ //|global integer variables | //+------------------------------------------------------------------+ int size_insample, //training set size size_outsample, //testing set size size_observations, //size of of both training and testing sets combined size_lambdas, //number of lambdas to be tested size_predictors, //number of predictors maxperiod, //maximum lookback price_handle=INVALID_HANDLE, //log prices indicator handle long_ma_handle=INVALID_HANDLE, //long moving average indicator handle short_ma_handle=INVALID_HANDLE;//short moving average indicator handle //+------------------------------------------------------------------+ //|double global variables | //+------------------------------------------------------------------+ double prices[], //array for log transformed prices targets[], //differenced prices kept here predictors_matrix[], //flat array arranged as matrix of all predictors_matrix ie size_observations by size_predictors longma[], //long ma indicator values Lambdas[], //calculated lambdas kept here Lambdas_OOS[], //calculated out of sample lambdas are here shortma[], //short ma indicator values Lambda; //initial optimal lambda value //+------------------------------------------------------------------+ //| Coordinate descent pointer | //+------------------------------------------------------------------+ CCoordinateDescent *cdmodel; //coordinate descent pointer //+------------------------------------------------------------------+ //| Script program start function | //+------------------------------------------------------------------+ void OnStart() { //get relative shift of is and oos sets int teststart,teststop,trainstart,trainstop; teststart=iBarShift(SetSymbol!=""?SetSymbol:NULL,tf,TestingSampleStartDate); teststop=iBarShift(SetSymbol!=""?SetSymbol:NULL,tf,TestingSampleStopDate); trainstart=iBarShift(SetSymbol!=""?SetSymbol:NULL,tf,TrainingSampleStartDate); trainstop=iBarShift(SetSymbol!=""?SetSymbol:NULL,tf,TrainingSampleStopDate); //check for errors from ibarshift calls if(teststart<0 || teststop<0 || trainstart<0 || trainstop<0) { Print(ErrorDescription(GetLastError())); return; } //---set the size of the sample sets size_observations=(trainstart - teststop) + 1 ; size_outsample=(teststart - teststop) + 1; size_insample=(trainstart - trainstop) + 1; maxperiod=int(Num_MA_periods*MA_period_inc); size_insample-=maxperiod; size_lambdas=NumLambdasToTest; size_predictors=int(Num_MA_periods); //---check for input errors if(size_lambdas<=0 || size_insample<=0 || size_outsample<=0 || size_predictors<=0 || maxperiod<=0 || BarsLookAhead<=0) { Print("Invalid inputs "); return; } //--- Comment("resizing buffers...");

Arrays that will passed to the CCoordinateDescent instance are prepared and filled, this being the targets array and the matrix of predictors.

//---allocate memory if(ArrayResize(targets,size_observations)<(int)size_observations || ArrayResize(predictors_matrix,size_observations*size_predictors)<int(size_observations*size_predictors) || ArrayResize(Lambdas,size_lambdas)<(int)size_lambdas || ArrayResize(Lambdas_OOS,size_lambdas)<(int)size_lambdas || ArrayResize(shortma,size_observations)<(int)size_observations || ArrayResize(longma,size_observations)<(int)size_observations || ArrayResize(prices,size_observations+BarsLookAhead)<int(size_observations+BarsLookAhead)) { Print("ArrayResize error ",ErrorDescription(GetLastError())); return; } //--- Comment("getting price predictors_matrix..."); //---set prices handle price_handle=iCustom(SetSymbol!=""?SetSymbol:NULL,tf,"::Indicators\\LogPrices.ex5",AppliedPrice); if(price_handle==INVALID_HANDLE) { Print("invalid logprices handle ",ErrorDescription(GetLastError())); return; } //--- Comment("getting indicators..."); //----calculate the full collection of predictors_matrix int longmaperiod,shortmaperiod,prevshort,prevlong; int k=0; //--- prevlong=prevshort=0; //--- for(uint iperiod=0; iperiod<Num_MA_periods; iperiod++) { longmaperiod=(int)(iperiod+1)*int(MA_period_inc); shortmaperiod = (longmaperiod>=2)?int(longmaperiod/2):longmaperiod; ResetLastError(); int try=10; while(try) { long_ma_handle=iMA(SetSymbol!=""?SetSymbol:NULL,tf,longmaperiod,0,MaMethod,price_handle); short_ma_handle=iMA(SetSymbol!=""?SetSymbol:NULL,tf,shortmaperiod,0,MaMethod,price_handle); if(long_ma_handle==INVALID_HANDLE || short_ma_handle==INVALID_HANDLE) try--; else break; } Comment("copying buffers for short ",shortmaperiod," long ",longmaperiod); if(CopyBuffer(long_ma_handle,0,teststop,size_observations,longma)<=0 || CopyBuffer(short_ma_handle,0,teststop,size_observations,shortma)<=0) { Print("error copying to ma buffers ",GetLastError()); return; } for(int i=0 ; i<int(size_observations) ; i++) predictors_matrix[i*size_predictors+k] = shortma[i]-longma[i]; ++k ; if(long_ma_handle!=INVALID_HANDLE && short_ma_handle!=INVALID_HANDLE && IndicatorRelease(long_ma_handle) && IndicatorRelease(short_ma_handle)) { long_ma_handle=short_ma_handle=INVALID_HANDLE; prevlong=longmaperiod; prevshort=shortmaperiod; } } //--- Comment("filling target buffer..."); //--- ResetLastError(); if(CopyBuffer(price_handle,0,teststop,size_observations+BarsLookAhead,prices)<int(size_observations+BarsLookAhead)) { Print("error copying to price buffer , ",ErrorDescription(GetLastError())); return; } //--- for(int i=0 ; i<int(size_observations); i++) targets[i] = prices[i+BarsLookAhead]-prices[i]; //---

Lambda tuning is done depending on the value of Alpha. When alpha is less than or equal to zero, no optimal lambda is calculated. The result will be a model that resembles standard linear regression without any regularization.

//--- Comment("optional lambda tuning..."); //--- if(Alpha<=0) Lambda=0; else //train Lambda=OptimizeLambda(size_insample,size_predictors,(int)Num_Folds,UseCovarUpdates,size_lambdas,Alpha,(int)MaximumIterations,1.e-9,UseFastTest,predictors_matrix,targets,Lambdas,Lambdas_OOS,ShowFullOutPut); //---

Once training is completed by the CCoordinateDescent object the results can be optionally output to the terminal.

Comment("coordinate descent engagement..."); //---initialize CD object cdmodel=new CCoordinateDescent(size_predictors,size_insample,UseCovarUpdates,0); //--- if(cdmodel==NULL) { Print("error creating Coordinate Descent object "); return; } //---set the parameters and data cdmodel.SetData(0,size_insample,predictors_matrix,targets); //--- Print("optimal lambda ",DoubleToString(Lambda)); //---train the model cdmodel.Train(Alpha,Lambda,(int)MaximumIterations,1.e-7,UseFastTest,UseWarmStart); //--- Print("explained variance ",cdmodel.GetExplainedVariance()); //---optionally output results of training here if(ShowFullOutPut) { k=0; string output; for(uint iperiod=0; iperiod<Num_MA_periods; iperiod++) { longmaperiod=(int)(iperiod+1)*int(MA_period_inc); output+=StringFormat("\n%5d ", longmaperiod) ; shortmaperiod = (longmaperiod>=2)?int(longmaperiod/2):longmaperiod; output+=StringFormat(",%5d ,%9.9lf ", shortmaperiod,cdmodel.GetBetaAt(k)); ++k; } Print(output); } //---

Program output will be displayed in columns, the first column shows the long moving average period, the second displays the corresponding short moving average and finally the beta value for that particular predictor is given. If zero is displayed, it means that this predictor was discarded.

double sum=0.0; //cumulated predictions double pred; //a prediction int xptr; k=size_observations - (size_insample+maxperiod) - 1; //--- Comment("test the model..."); //---do the out of sample test for(int i=k ; i<size_observations ; i++) { xptr = i*size_predictors ; pred = 0.0 ; for(int ivar=0 ; ivar<int(size_predictors) ; ivar++) pred += cdmodel.GetBetaAt(ivar) * (predictors_matrix[xptr+ivar] - cdmodel.GetXmeansAt(ivar)) / cdmodel.GetXscalesAt(ivar) ; pred = pred * cdmodel.GetYscale() + cdmodel.GetYmean() ; // Unscale prediction to get it back in original Y domain if(pred > 0.0) sum += targets[i] ; else if(pred < 0.0) sum -= targets[i] ; } //--- PrintFormat("OOS total return = %.5lf (%.3lf percent)",sum, 100.0 * (exp(sum) - 1.0)) ; //--- delete cdmodel; //--- Comment("");

The program ends after examining performance over the selected testing period. Users should note that the perfomance value displayed at program end is not an indication of true performance as there is a lot not taken into consideration. These figures should be used relative to other results obtained from different program parameter sets.

The output below shows the results when Alpha is 0. As stated earlier, when alpha is 0, there is no regularization, the model is built using all the supplied predictors, none are left out.

DH 0 19:58:47.521 ELN_MA (GBPUSD,D1) optimal lambda 0.00000000 HP 0 19:58:47.552 ELN_MA (GBPUSD,D1) explained variance 0.9914167039554915 ID 0 19:58:47.552 ELN_MA (GBPUSD,D1) FF 0 19:58:47.552 ELN_MA (GBPUSD,D1) 2 , 1 ,1.85143599128379721108e+00 JJ 0 19:58:47.552 ELN_MA (GBPUSD,D1) 4 , 2 ,-2.44139247803866465958e+00 MR 0 19:58:47.552 ELN_MA (GBPUSD,D1) 6 , 3 ,2.32230838054034549600e+00 HF 0 19:58:47.552 ELN_MA (GBPUSD,D1) 8 , 4 ,-2.35763762038486313077e-01 FJ 0 19:58:47.552 ELN_MA (GBPUSD,D1) 10 , 5 ,-5.12822602346063693979e-01 MP 0 19:58:47.552 ELN_MA (GBPUSD,D1) 12 , 6 ,-2.63526268082343251287e-01 CF 0 19:58:47.552 ELN_MA (GBPUSD,D1) 14 , 7 ,-4.66454472659737495732e-02 FN 0 19:58:47.552 ELN_MA (GBPUSD,D1) 16 , 8 ,6.22551516067148258404e-02 KP 0 19:58:47.552 ELN_MA (GBPUSD,D1) 18 , 9 ,9.45364603399752728707e-02 JK 0 19:58:47.552 ELN_MA (GBPUSD,D1) 20 , 10 ,8.71627177974267641769e-02 JM 0 19:58:47.552 ELN_MA (GBPUSD,D1) 22 , 11 ,6.43970377784374714558e-02 CG 0 19:58:47.552 ELN_MA (GBPUSD,D1) 24 , 12 ,3.92137206481772693234e-02 FI 0 19:58:47.552 ELN_MA (GBPUSD,D1) 26 , 13 ,1.74528224486318189745e-02 HS 0 19:58:47.552 ELN_MA (GBPUSD,D1) 28 , 14 ,1.04642691815316421500e-03 PG 0 19:58:47.552 ELN_MA (GBPUSD,D1) 30 , 15 ,-9.98741520244338966406e-03 RM 0 19:58:47.552 ELN_MA (GBPUSD,D1) 32 , 16 ,-1.64348263919291276425e-02 CS 0 19:58:47.552 ELN_MA (GBPUSD,D1) 34 , 17 ,-1.93143258653755492404e-02 QI 0 19:58:47.552 ELN_MA (GBPUSD,D1) 36 , 18 ,-1.96075858211104264717e-02 FO 0 19:58:47.552 ELN_MA (GBPUSD,D1) 38 , 19 ,-1.81510403514190954422e-02 RD 0 19:58:47.552 ELN_MA (GBPUSD,D1) 40 , 20 ,-1.56082180218151990447e-02 PJ 0 19:58:47.552 ELN_MA (GBPUSD,D1) 42 , 21 ,-1.24793265043600110076e-02 HP 0 19:58:47.552 ELN_MA (GBPUSD,D1) 44 , 22 ,-9.12541199880392318866e-03 MF 0 19:58:47.552 ELN_MA (GBPUSD,D1) 46 , 23 ,-5.79584482050124645547e-03 DL 0 19:58:47.552 ELN_MA (GBPUSD,D1) 48 , 24 ,-2.65399377323665905393e-03 PP 0 19:58:47.552 ELN_MA (GBPUSD,D1) 50 , 25 ,2.00883928121427593472e-04 RJ 0 19:58:47.552 ELN_MA (GBPUSD,D1) 52 , 26 ,2.71594753051577000869e-03 IL 0 19:58:47.552 ELN_MA (GBPUSD,D1) 54 , 27 ,4.87097208116808733092e-03 IF 0 19:58:47.552 ELN_MA (GBPUSD,D1) 56 , 28 ,6.66787159270224374930e-03 MH 0 19:58:47.552 ELN_MA (GBPUSD,D1) 58 , 29 ,8.12292277995673578372e-03 NR 0 19:58:47.552 ELN_MA (GBPUSD,D1) 60 , 30 ,9.26111235731779183777e-03 JG 0 19:58:47.568 ELN_MA (GBPUSD,D1) OOS total return = 3.42660 (2977.187 percent)

Below is output when Alpha is 0.1. Of interest are beta values in comparison to the previous run. Zero beta values show that the corresponding predictor was discarded.

NP 0 19:53:32.412 ELN_MA (GBPUSD,D1) optimal lambda 0.00943815 HH 0 19:53:32.458 ELN_MA (GBPUSD,D1) explained variance 0.9748473636648924 GL 0 19:53:32.458 ELN_MA (GBPUSD,D1) GN 0 19:53:32.458 ELN_MA (GBPUSD,D1) 2 , 1 ,1.41004781317849103850e+00 MR 0 19:53:32.458 ELN_MA (GBPUSD,D1) 4 , 2 ,-6.98106822708694618740e-01 DJ 0 19:53:32.458 ELN_MA (GBPUSD,D1) 6 , 3 ,0.00000000000000000000e+00 NL 0 19:53:32.458 ELN_MA (GBPUSD,D1) 8 , 4 ,1.30221271072762545540e-01 MG 0 19:53:32.458 ELN_MA (GBPUSD,D1) 10 , 5 ,1.13824982442231326107e-01 DI 0 19:53:32.458 ELN_MA (GBPUSD,D1) 12 , 6 ,0.00000000000000000000e+00 IS 0 19:53:32.458 ELN_MA (GBPUSD,D1) 14 , 7 ,0.00000000000000000000e+00 NE 0 19:53:32.458 ELN_MA (GBPUSD,D1) 16 , 8 ,0.00000000000000000000e+00 GO 0 19:53:32.458 ELN_MA (GBPUSD,D1) 18 , 9 ,0.00000000000000000000e+00 JP 0 19:53:32.458 ELN_MA (GBPUSD,D1) 20 , 10 ,0.00000000000000000000e+00 DH 0 19:53:32.458 ELN_MA (GBPUSD,D1) 22 , 11 ,-3.69006880128594713653e-02 OM 0 19:53:32.458 ELN_MA (GBPUSD,D1) 24 , 12 ,-2.43715386443472993572e-02 LS 0 19:53:32.458 ELN_MA (GBPUSD,D1) 26 , 13 ,-3.50967791710741789518e-03 DK 0 19:53:32.458 ELN_MA (GBPUSD,D1) 28 , 14 ,0.00000000000000000000e+00 LM 0 19:53:32.458 ELN_MA (GBPUSD,D1) 30 , 15 ,0.00000000000000000000e+00 KG 0 19:53:32.458 ELN_MA (GBPUSD,D1) 32 , 16 ,0.00000000000000000000e+00 RI 0 19:53:32.458 ELN_MA (GBPUSD,D1) 34 , 17 ,0.00000000000000000000e+00 ES 0 19:53:32.458 ELN_MA (GBPUSD,D1) 36 , 18 ,0.00000000000000000000e+00 PE 0 19:53:32.458 ELN_MA (GBPUSD,D1) 38 , 19 ,0.00000000000000000000e+00 KO 0 19:53:32.458 ELN_MA (GBPUSD,D1) 40 , 20 ,0.00000000000000000000e+00 NQ 0 19:53:32.458 ELN_MA (GBPUSD,D1) 42 , 21 ,0.00000000000000000000e+00 QK 0 19:53:32.458 ELN_MA (GBPUSD,D1) 44 , 22 ,0.00000000000000000000e+00 PM 0 19:53:32.458 ELN_MA (GBPUSD,D1) 46 , 23 ,0.00000000000000000000e+00 GG 0 19:53:32.458 ELN_MA (GBPUSD,D1) 48 , 24 ,0.00000000000000000000e+00 OI 0 19:53:32.458 ELN_MA (GBPUSD,D1) 50 , 25 ,0.00000000000000000000e+00 PS 0 19:53:32.458 ELN_MA (GBPUSD,D1) 52 , 26 ,0.00000000000000000000e+00 RE 0 19:53:32.458 ELN_MA (GBPUSD,D1) 54 , 27 ,1.14149417738317331301e-03 FO 0 19:53:32.458 ELN_MA (GBPUSD,D1) 56 , 28 ,3.18638349345921325848e-03 IQ 0 19:53:32.458 ELN_MA (GBPUSD,D1) 58 , 29 ,3.87574752936066481077e-03 KK 0 19:53:32.458 ELN_MA (GBPUSD,D1) 60 , 30 ,3.16472282935538083357e-03 QN 0 19:53:32.474 ELN_MA (GBPUSD,D1) OOS total return = 3.40954 (2925.133 percent)

Next we view the output when Alpha is 0.9, this time we highlight the ouput from LambdaOptimize. The first column is the lambda value tested , the second column shows the number of predictors included in the model, and the last column shows the fraction of explained variance from the test, for a particular fold. In the script we specified 10 folds, so there are ten tables of this data.