SST Kill Shot

- Эксперты

- Stock Sniper Trading Corp.

- Версия: 1.12

- Обновлено: 19 сентября 2023

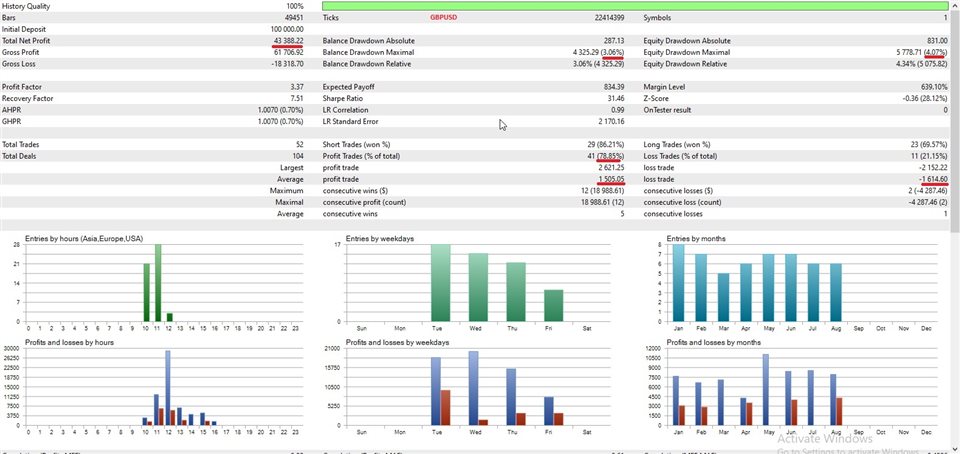

- Активации: 5

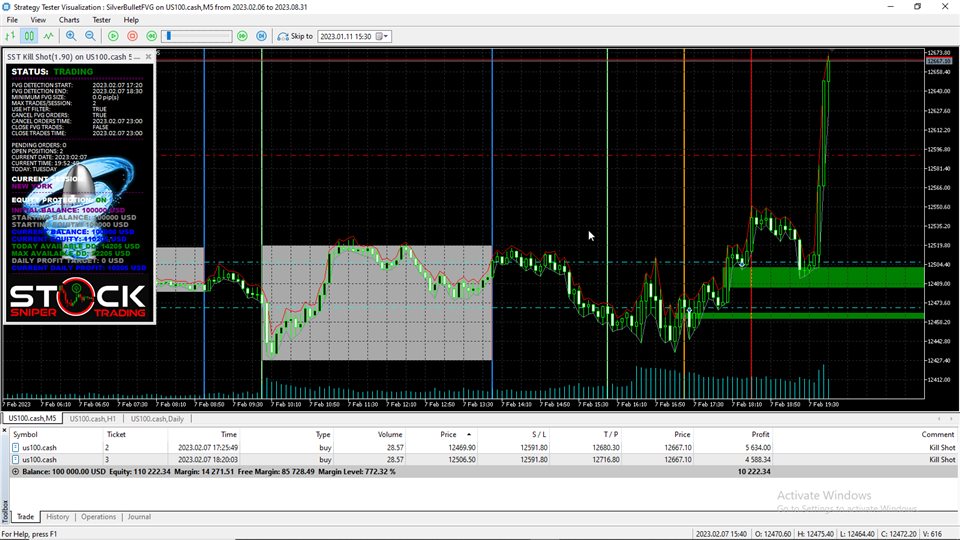

Stock Sniper Trading proudly presents SST Kill Shot, our kill zone strategy which is our own unique adaptation of the famous 'Silver Bullet' strategy where we target the fair value gaps / imbalances that form during the first hour of a trading session. High volatility as a result of above normal volume transactions and market orders that take place during the first hour of the trading session will create gaps in the market (which tend to act like a magnet for price to pull back into and grab the remaining liquidity), thereby giving us a clear depiction of whether the bulls or bears are in control during that time period in which we will define our trade entries.

SST Kill Shot meticulously identify the FVG's and place pending market orders in and around those areas of interest only during the specified kill zone timeframe, depending on the highly customizable input parameters SST Kill Shot will determine if a viable trade entry exist.

SST Kill Shot should work on basically any trading instrument, if the parameters of our EA are correctly defined. We do however specialize and are famous for trading the Indices (stocks), therefore we have focused mostly on the Indices during the testing phases of this EA. We will provide a base set file for NASDAQ to potential buyers who would like to try the demo version out first. A detailed user manual will be provided with the rental or purchase of the EA, simply send us a message and we will reply with a link to the user manual. The manual will include exactly how to setup the EA, testing the EA and optimize the parameters for current market conditions, a description of every single EA parameter that can be optimized and what it does and of course how to apply the EA to start trading 'live', whether you want to trade only one instrument at a time or a couple of instances of the EA across multiple charts. We do recommend splitting your risk and increase trading frequency to at least run one instance of Kill Shot during the London session, and another during the New York session. We also advice that funded accounts should preferably not risk more than 1% per day, i.e. risk 0.25% during London and 0.75% during New York session or whichever way you like.

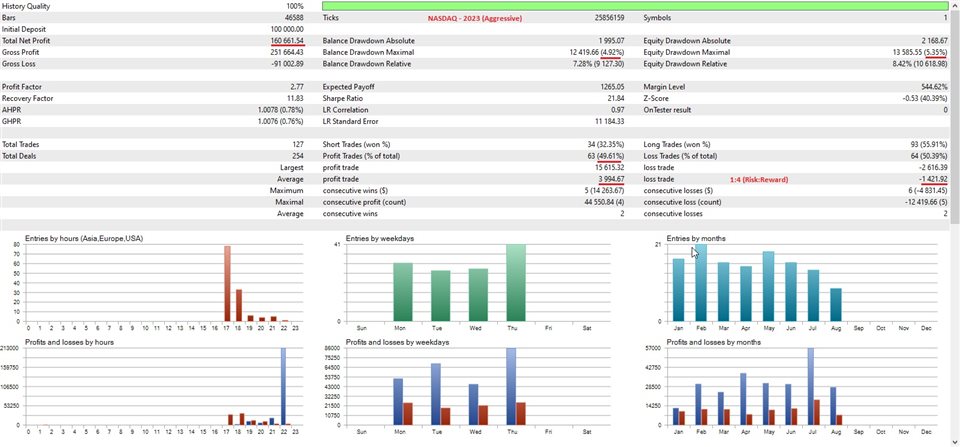

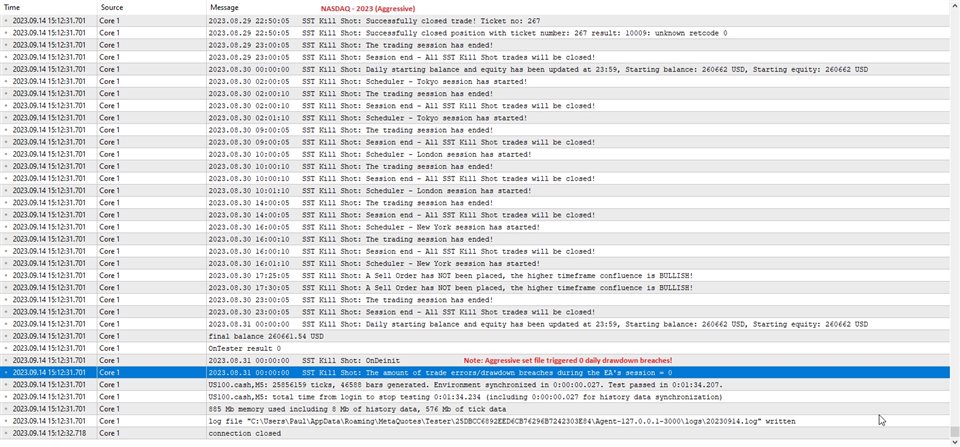

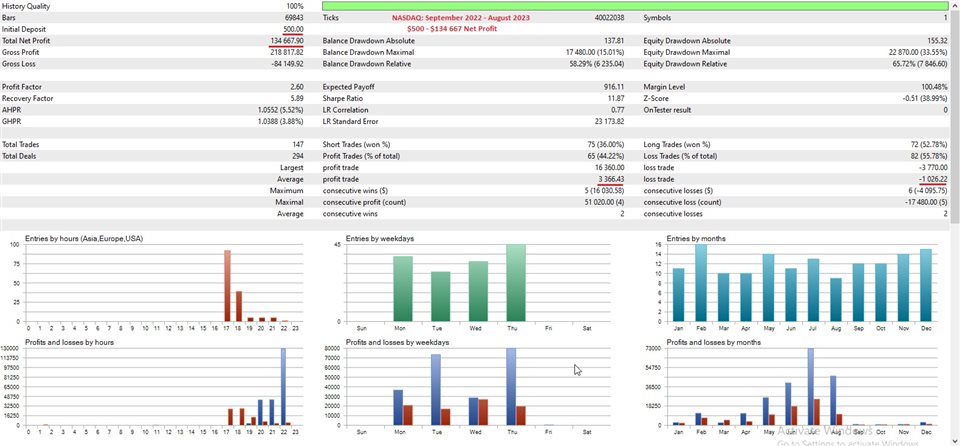

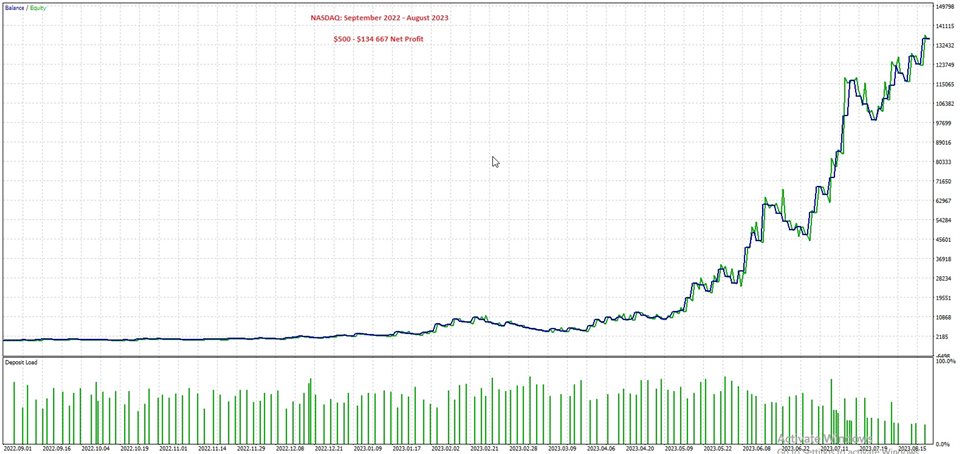

Please note: SST Kill Shot has been designed with personal as well as especially funded trading accounts in mind. Due to the drawdown limits of proprietary trading firms, our EA was designed and developed with proper risk management techniques and includes an equity protection system that will protect the account from breaching the daily drawdown limits these firms impose. This strategy has proven to show the best results on the NASDAQ during the New York session, and for all indices we start the trade detection process from 10AM EST until 11AM EST for New York, and for London session it will be from 3AM EST until 4AM EST.

We have a dedicated team of developers who will provide support and feedback as quickly as possible! New features and customer suggestions will be considered and improving the EA's performance is of high priority for us. Optimized set files for other instruments will be created and supplied to all our clients.

Recommendations:

- Instruments: NASDAQ/S&P500

- Timeframe: M5

- Minimum deposit: $500

- Account type: Any

- Brokers: FTMO/Any other prop firm using a regulated broker/or any other broker for personal accounts

Specifications:

- Trade entry criteria for kill zone hours, orders etc.

- Trade filters including but not limited to the max amount of trades/session, aggressive entries, making use of higher timeframe filter etc.

- Trade setup whether you would like to buy or sell only, percentage risk/trade or a fixed lot, dynamic and fixed settings for both the take profit (TP) as well as the stop loss (SL) etc.

- Trade management options include a portfolio of settings like partial profits, different breakeven options as well as various trailing stop options. Note: We include flexible trade management options as a standard to all our EA's, but this strategy naturally performs well with a very high R:R ratio and with no trade management at all, as long as all trades are closed at the end of the trading session! Trade management does however bring the DD down considerably with a higher success rate, configure to your style and risk tolerance!

- A Trading scheduler to keep your trades running/opening or closing only during or after a certain trading session of the day. We included options to define a Tokyo session, London session and New York session and which days of the week you would like to trade. All sessions are marked up on the chart clearly indicating the trading zone of the sessions that was traded, as well as helping the trader with other confluences like Highs and Lows of potential liquidity sweeps etc.

- Equity protection to protect your account from going into unwanted drawdown daily, and an overall drawdown limiter. You can also select to secure a certain amount of profit for the day and the EA will automatically stop trading for that day.

- System settings can be altered to adapt to the user's computer, the timer will increase the speed of back testing tremendously and especially for those with slower computer configurations. Note: Every tick is preferred or at least every 10 second intervals!

- Visual settings include showing or hiding the information panel, the EA logo, kill zone identification and the display and colors of the trading sessions etc.

Disclaimer: Although we will do everything in our power to ensure long term success, past performance does not guarantee future results, and we at Stock Sniper Trading will not be held accountable for the use of our product(s), whether a loss of the account or any equity loss has been caused by a very drastic change in market sentiment/volatility, or the misuse or abuse of our product by the user, making use of untested or non-optimized EA parameters!

Please note: Send us a private message after your purchase/rental, we will then send you a link to the set files and user manual. Link to default set file and social media links please see "Comments" section!